John Doe

SupervisorAlias ab gravida tempor, elementum natus aenean tempore, penatibus nisi primis arcu, per atque fuga nihil consequatur lorem massa porta

Content

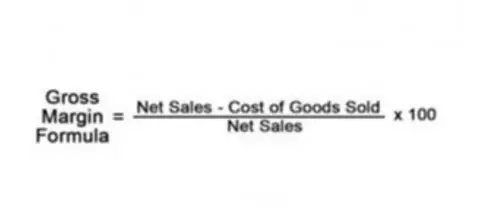

Depreciate the company car v. sole proprietor’s car and separating depreciation of business v. personal use. You will learn how to find and correct errors in the general ledger . Do the monthly bank reconciliation and record the related journal entries. QuickBooks® has replaced the manual entry functions of traditional bookkeeping.

The NACPB certified bookkeeper exam includes 50 multiple-choice simulations and questions. You must answer 37 questions out of 50 correctly to earn a score of 75 percent if you want to pass. You could work as a certified bookkeeper, freelance bookkeeper, tax preparer, payroll clerk, billing clerk, accounting assistant, or even an accounts payable or accounts receivable clerk.

AIPB is best suited for people with no formal education but at least two years of experience in the field. Courses prepare candidates for the national Certified Bookkeeper exam, which tests knowledge of payroll, depreciation, inventory and much more. In addition, candidates must submit an application, meet work experience requirements, pass a four-part exam, adhere to the Code of Ethics, and complete 24 hours of continuing education annually. It’s a sizable list where candidates benefit from investing in courses that show a commitment to the profession. For example, bookkeepers should know how to work with existing and emerging software including Microsoft Excel, Payroll and Quickbooks.

Tim is a certified bookkeeper QuickBooks Time Pro, QuickBooks ProAdvisor, and CPA with 25 years of experience. Get tips for success from 10 in-field experts to help you climb the career ladder and increase your earning potential. Earning a certification demonstrates that a person is at the top of their profession and a high performer eligible for pay and opportunities. Gain insights for every career stage in our free Accounting Career Guide. Meghan Gallagher is a Seattle-based freelance content writer and strategist.

Only 12% of entry-level bookkeepers have a bachelor’s degree, so having one is an easy way to gain an advantage. Consider a bachelor’s degree in accounting, business administration, or finance. The BLS notes that job prospects for bookkeeping, accounting and auditing clerks are expected to decline by 6 percent between 2019 and 2029. The projected job growth trend for all occupations combined is expected to grow by 4 percent, in comparison.

However, if you want certification, you will have to purchase the CFI self-study bundle and FMVA certification. The paid courses offer quizzes and projects, and a course certificate upon completion. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

Some benefits of the career path include plenty of remote work possibilities and the ability to work in a wide range of industries. The Small Business Administration offers a free and quick 30-minute training course introducing you to accounting. Upon completion, you get a free PDF course completion certificate with your name on it from the SBA. Becoming a certified bookkeeper not only enhances your credibility, but increases your earning potential too.

Many small businesses use bookkeepers as their sole financial officer who keeps watch on their accounts, according to the American Institute of Professional Bookkeepers . Certified bookkeepers may be tasked with performing duties that require substantial financial expertise and training. Speaking of such, climbing the career ladder can be easier with a bookkeeping certification. The certification proves that you’re willing to go above and beyond what your job entails. You can’t argue with a certification, as it proves your proficiency in an area. If you have bookkeeping certifications in targeted niches within your industry such as taxes or accounting, this might allow you to branch out and expand your work responsibilities.

The QuickBooks Online ProAdvisor certification is an amazing resource for bookkeepers (for FREE!) that so many beginners don’t know about. This is pretty much an industry standard for bookkeepers, as QuickBooks is the most popular accounting software in the United States. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances.

Intuit Bookkeeping Expert Network Remote Bookkeeping Jobs ….

Posted: Fri, 08 Apr 2022 09:48:17 GMT [source]

The most important aspects of being a bookkeeper is knowing your software, having basic knowledge of keeping books, and you’re confident you can help your clients. I personally didn’t get “officially” certified until I’d been a bookkeeper for a few years. Bookkeepers can also obtain additional certification showing their mastery of Intuit QuickBooks, the most popular accounting software for small businesses. Consider taking the QuickBooks certified user exam or pursuing the Intuit certified bookkeeping professional credential. Exams are available at Certiport authorized testing centers across the U.S. Bookkeepers produce and manage financial records for small businesses, nonprofit organizations, and accounting firms.

If you’re wondering whether to earn CB certification or CPB licensure, keep in mind that a professional designation can help boost your earning potential. According to Payscale, certified bookkeepers make around $52,000 each year. The first step to becoming a certified bookkeeper is ensuring you’ve met all professional and educational requirements. Regardless of whether you are pursuing credentials through AIPB or NACPB, your supervisor or a former employer must validate your experience hours. A bookkeeping certification not only adds value to your skill set but also helps you stay on top of the latest trends and technological advances in the industry.